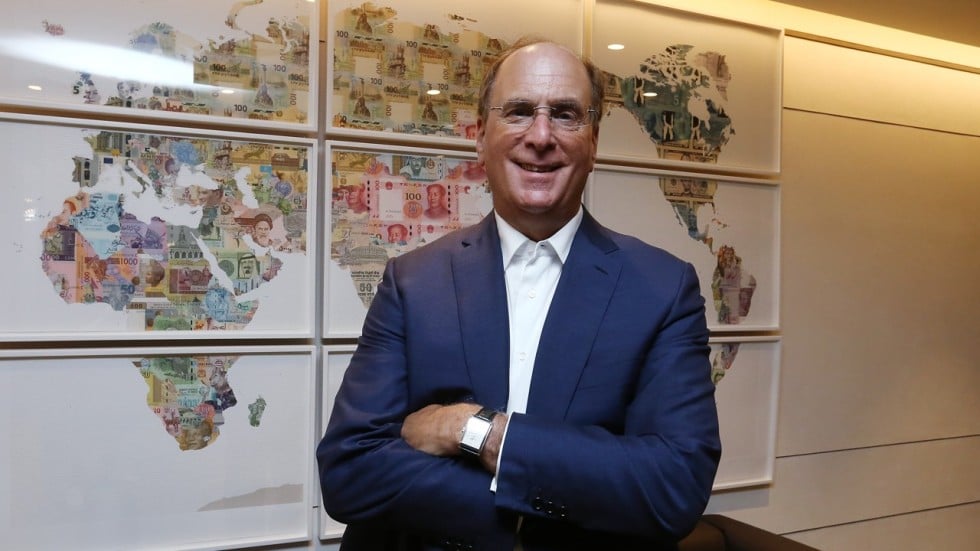

Over the past four years, most sustainability professionals I know have been looking forward to Larry Fink’s letter to S&P 500 CEOs at the beginning of each year. The anticipation surrounding these annual letters from BlackRock’s CEO is due to the fact that we have the world’s largest asset owner voicing what sustainability practitioners have long been advocating of businesses. Fink, a leader in the investment community, has been telling business leaders that they are accountable for their societal impact and need to adapt to thinking about sustainability as long-term profitability, and not just as a PR device, philanthropic or luxury investment. In short, they need to take a position of leadership in sustainability.

Despite coming from such a respected and powerful business leader in calling other CEOs to action when it comes to demonstrating their companies have longer term focuses and are making positive contributions to society, how impactful are these words in the long-run? How many believe that a CEO’s first and foremost responsibility will shift from their investors, and maximizing shareholder value, and what will be the reactions and more importantly, concrete actions from business leaders after reading Fink’s letter?

To be sure, BlackRock’s CEO is not the first to address issues of social responsibility and recognize that integrating sustainability into a business strategy is a smart move that delivers long-term, tangible results. Jack Ma, the founder of Alibaba, wrote a similar letter to the company’s investors in 2014. Ma, the richest man in China, pledged that Alibaba will put “customers first, employees second, and shareholders third” as social responsibility has always been embedded in the company’s DNA. Ma has been quite outspoken in saying that “businesses in the 21st century must take responsibility to help solve the problems of society” in order to create long-term value because a “healthy and prosperous ecosystem can only be achieved through solving large-scale problems of society.” Tim Cook, the CEO of Apple, has also said that as governments seem to be failing to prepare for long-term societal issues, companies need to step up and embrace “moral responsibility to help grow the economy, to help grow jobs, to contribute to this country and to contribute to the other countries that we do business in.”

Undoubtedly, these CEOs are in positions of power and influence where they can harness the capital markets and their businesses can help to address some of the challenges facing society and the environment by executing scalable solutions. Furthermore, like Ma, Fink, and Cook, many CEOs are faced with the reality that “society is demanding that companies, both public and private, serve a social purpose. To prosper over time, every company must not only deliver financial performance, but also show how it makes a positive contribution to society.”

A company’s ability to integrate sustainability/ESG (environmental, social, and governance) factors into their business strategy and investment process is indicative of good management and corporate governance, which are essential to healthy, sustainable financial growth. Several financial studies have shown that high ESG ratings correlate with lower stock price volatility and higher returns; share prices of companies which have social and environmental targets or goals outperformed their peers without such goals by 47 percent. However, businesses are not altruistic institutions and should not have the mandate to fix larger social issues and save the world, but they are best positioned to care the most about sustainable business growth and long-term performance, including positive impact on society.

But how will companies continue to grow with purpose, both while keeping their shareholders happy and without being criticized for being a PR ploy, or that they are simply appeasing regulators and completing a tick-box exercise?

There are various impact investing platforms which are looking at how you can add financial value through sustainability:

- Generation Investment Fund (established in 2004) – The fund was founded by seven partners, including Al Gore and David Blood (CEO of Goldman Saks from 1993-2003), and is managing over USD 17 billion in assets. The fund has an investment strategy that carries out equity research and analysis through a sustainability lens to invest in high-quality, sustainable businesses, which has resulted in strong investment returns.

- Global Real Estate Sustainability Benchmark (GRESB) (established in 2009) – The global ESG benchmark for real assets covering real estate, debt, and infrastructure was an investor led initiative. It is now the global standard for the industry with more than 70 institutional and retail investors, representing over USD 17 trillion in the institutional capital, using sustainability benchmark data to enhance and protect shareholder value.

- The Morgan Stanley Institute for Sustainable Investing (established in 2013) – Morgan Stanley and CEO James Gorman intend to provide individuals and institutional investors with products and strategies that address sustainability challenges and help address the most pressuring societal challenges we are facing today.

What’s happening in China?

While we are still reading news around Fink’s letter to CEO’s to raise the bar, the responses have been mixed; some are encouraged while others are skeptical of what tangible changes will come about. The west seems to “need” these letters because the issues are intangible, but in China and the hyper-developing world, the social and environmental issues are tangible and thus scalability of sustainability solutions by the business world is real.

The ecosystem in China, the scale of ambition, the size of the country, the need for resources and innovation, and ambition from the top, have provided opportunities to create new business paradigms and positive change. In fact, there has been an increasing trend of sustainability-themed investments and green finance in China. China announced the goal of establishing a green financial system, to advance green investments, and to transition towards a sustainable economy in the 13th Five Year Plan in March 2016. China issued its first green bond in 2015 and now in 2018 has become the world’s largest green bond market, which is heavily regulated in comparison to other countries.

China’s E Fund Management, the third largest asset manager in China (about RMB 1.1 trillion) partnered with APG Asset Management in 2017 to establish the world’s first China-focused Sustainability and Responsibility Investment Strategy. E Fund has equipped itself for ESG investments and “will translate its efforts into a tangible investment strategy to produce positive investment returns” with this strategic partnership with APG, Europe’s largest pension fund (USD 471 billion) which is one of the few globally that applies responsible investment policies to all asset classes. APG and E Fund have also launched a “Financial Future Planning Academy” to serve as a think tank for sustainable and responsible investing.

China has also demonstrated the move away from measuring economic development by GDP growth alone and is measuring improvements to people’s welfare and livelihoods. The Chinese government is estimated to spend USD 1.6 trillion in the next five years, with commitments to invest in energy saving and environmental protection industries, while implementing policies advancing the “War on Pollution” and cessation of being the “waste bin of the world”.

(See our research on China’s Environmental Tax and China’s Waste Ban).

China has also announced a goal to end poverty by 2020. Jack Ma, a former teacher himself, is famous for his outspokenness on and philosophy about social entrepreneurship. He’s consistently stressed Alibaba’s vision and responsibility of social impact on a global scale and has recently called for 100 entrepreneurs to build schools for the estimated 60 million left behind children across China. (See our research on left behind children and the labor market in China). In 2017, as part of the company’s strategic goals, Alibaba also set up a RMB 10 billion (USD 1.51 billion) Poverty Relief Fund to support China’s goal to eliminate poverty by 2020.

(See our research on 2018 – The Year Sustainability Goes Strategic in China).

While we can expect the Chinese government to develop clearer guidelines and regulations for the green finance market and promote sustainable development in China, as Tim Cook said, “the reality is that [most] government[s] for a long period of time, has for whatever set of reasons become less functional and isn’t working at the speed that it once was. And so it does fall […] not just on business but on all other areas of society to step up.” Unlike the west, the largest pressure to solve social and environmental issues in China come from within the country and are tied to economic growth. We expect this will catalyze an explosion of business opportunities and innovation to address local sustainability issues as the economic incentives are strong here.

Sustainability is a long-distance journey that begins with individual action and depends on collaboration. Leaders in all industries and sectors need to collectively bring each other along for the ride. Stay tuned as we take a closer look into what companies and innovators in China are doing to drive sustainability in various industries.

To learn more about how you can integrate sustainability into your business strategy and measure your social value, contact us at [email protected].