With an exploding urban population and a rising middle-class, China is rapidly increasing material use and consumption. Alongside its burgeoning economy is a proliferation of consumer waste.

While most debates are around the wastage of food or packaging materials like plastic and paper, little attention is paid to the old clothes that people clean out of their wardrobes. Chinese dump roughly 26 million tonnes of garments every year. Left untreated, textile waste is piling up at a catastrophic level, causing clogged landfills, environmental pollution, and health hazards.

From “Made in China” to World’s Dumpster

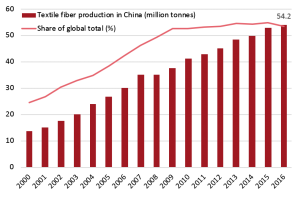

As the linchpin in the global textile and apparel supply chain, China manufactures nearly 65% of the world’s clothes and remains the largest apparel exporters. However, its dominance in textile production is being challenged due to the loss of competitive advantages such as low labor and environmental costs. While fashion brands and retailers are seeking alternative souring cases, China is gradually shifting its role towards a producer of specialized textile and fiber products as well as a major supplier for other apparel exporters, particularly in Asian countries such as Bangladesh, Cambodia, and Vietnam.

On the demand side, China’s apparel market is able to sustain a 4% growth thanks to the increasing household incomes and fast-growing e-commerce sector. Affordable luxury apparel is becoming popular among the rising middle class, whereas fast fashion brands are able to capture large market share through aggressive expansion. By 2025, the textile market size is expected to reach 450 billion USD, to which women wear and fast fashion contribute the most.

While cheap, new collections are more frequently available to Chinese consumers these days, the average lifespan of their clothes is shrinking drastically. Approximately 45% of the textile produced in China is wasted, ranging from industrial waste created in fiber, textile, and clothing production and consumer waste that people throw away from their closets. Of all collected waste, only 3.5 million tonnes were recycled and reused in 2017, which is equivalent to the use of 3.8 million tonnes of petroleum and 230 thousand hectares of farmland. It is predicted in “The Twelfth Five Year Plan” that the production of waste textiles will exceed 100 million tonnes in China. This means that 70 million tonnes of chemical fibers and 30 million tonnes of natural fibers will be used.

As the world’s largest textile manufacturer and top apparel market, China, especially municipalities and local waste industry is now facing an unprecedented crisis.

Clothing’s End-of-Life

Donation

Donating unwanted clothing to a charity shop has two-fold benefits: it gives clothes a second life while generating revenue for the charity. However, the donation market is declining significantly and strictly regulated by the government. According to China’s Ministry of Civil Affairs, donated clothing must be in excellent condition and winter wear is preferred. Qualified partners include 14,000 donations stations and 10,100 charity shops registered at civil affairs bureaus.

Resale

China bans the import of second-hand clothing but export is allowed. Many companies exports second-hand clothes to countries in Africa and Southeast Asia after sorting into piles based on potential margins. The sorting process is extremely labor-intensive and often fails to comply with environment, health, and safety standards. While it is still arguable whether a charitable donation can end up as a commodity, the importing nations tend to see the trade is detrimental to the local textile industry. Consequently, over 30 African countries have actually prohibited import embargos of used clothes.

Recycling

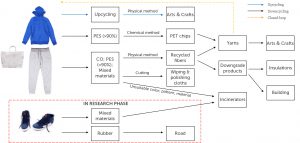

There are two types of recycling when it comes to textile waste. Mechanical recycling degrades waste into products decoration, construction, agricultural, and gardening use, whereas chemical recycling can produce fibers of equal quality compared to virgin materials. The Chinese government is actively promoting companies to recycle clothing of their own brands through both methods, with the possibility of rolling out a full mandate like the Extended Producer Responsibility for e-waste producers.

However, neither is scalable and profitable so far. Mechanical recycling of natural fibers like cotton and wool can produce a large number of recycled fibers but have to blend with virgin ones to increase resilience and quality. Chemical fiber recycling can only reprocess polyester and certain nylons and require a high quality of input.

Energy Recovery

In the absence of effective recycling practices, the prevailing approach is to send used clothes to waste-to-energy (WTE) incinerators. Once cut and shredded, the small pieces of textile waste serve a purpose of compensating the wet solid waste collected at household levels and on the curbside, increasing the burning efficiency. This method is particularly popular as WTE incineration facilities are considered renewable power generators, thus are eligible for tax refund up to 100%. The Chinese government expects the capacity to double between 2015 and 2020.

Gaps in Clothing Recycling

Although textile is now one of the fastest growing waste streams, few companies show a vested interest in recycling and reutilizing it. Meanwhile, municipalities and non-profit organizations are stepping up in the waste collection and sorting but still facing a lack of collection infrastructure, sorting and processing systems at scale, and economically viable recycling models.

The Economics of Waste

As textile wastes are considered a valuable commodity here compared to the developed world, China may find a way to resolve the recycling conundrum. Driven by economic incentives, there is an emergence of small and medium-size companies that down-cycle collected textiles into cloth and fibers. The recycled materials are then fed into different manufacturing processes to make new products. Unfortunately, unlike the e-waste recycling industry where collectors, recyclers, and manufacturers have built an entire economy around it, the textile recycling industry has yet seen the tangible business models. China is still trying to figure out the way to boost the recycling business.

Regulatory Environment

The standardization and regulation of textile waste collection and recycling are lagging behind in China. There is a lack of standards on the safety and quality of recycled products, management of recycling processes, and categorization of recyclable materials. Additionally, China has no national standard or certifications pertaining to the processing of textile wastes or the recycled products. Ministry of Industry and Information Technology has issued industry standards on recycled polyester chips and fibers, which serve as recommended practices for businesses. So far types of government support and incentives regarding the collection, sorting, and recycling of textile waste have not been specified.

To ensure that systems are developed to give those clothes an appropriate second life, some key questions need to be answered first, including:

- How do we find economically viable solutions to reduce waste?

- What are the major drivers behind recycling industry?

- What is needed to scale solutions?

In the upcoming weeks, we will delve into the key momenta, various stakeholders, and potential solution providers in China’s textile waste crisis. Stay tuned by following us on social media.

Feature Image Credit: Collective Responsibility