A significant trend in the current and future trajectory of Chinese healthcare is the increasing privatization of medical hospitals and clinics. This development is driven by both consumer desires for a more patient-centered experience and government initiatives that aim to distribute the burden of care from public hospitals. Despite the rapid expansion of private options, several barriers prevent private models from gaining widespread use and societal acceptance. As a part of our research, we interviewed multiple physicians and patients to understand the current perceptions of private healthcare.

Rapid Growth of Private Hospitals

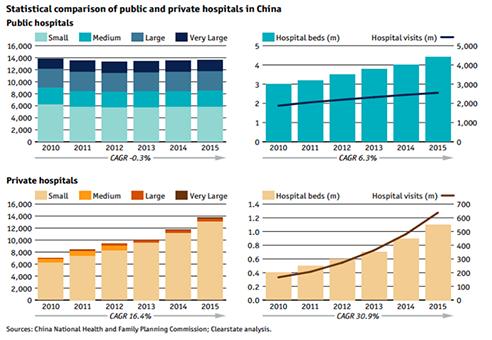

Within the last decade, there has been a nearly exponential growth of the number of private hospital beds, while public hospital growth has been comparatively stagnant. The compound annual growth (CAGR) for private hospital beds is 31%, compared to 6% for public hospitals. Additionally, the number of private hospitals in China doubled to a total of 16,900 hospitals in just six years, from 2011-2017, and now account for 57.2% of Chinese hospitals.

However, despite the growth in the number of facilities, private hospitals create significantly lower revenue compared to public hospitals. In 2016, private hospitals accounted for the majority of hospitals but generated less than 10% of the total revenue. The reasons for this discrepancy mostly lie in the lower patient volume. Private hospitals are more likely to be smaller and specialized hospitals, while public hospitals typically have more beds, staff, and tertiary care capacity. For example, the average public hospital has 280 beds and higher occupancy rates. Several “super hospitals” with >4,000 beds, such as Zhengzhou First Hospital, can receive up to a staggering 20,000 outpatients per day. In stark contrast, 83.5% of private hospitals have less than 100 beds and have an average occupancy of 40%.

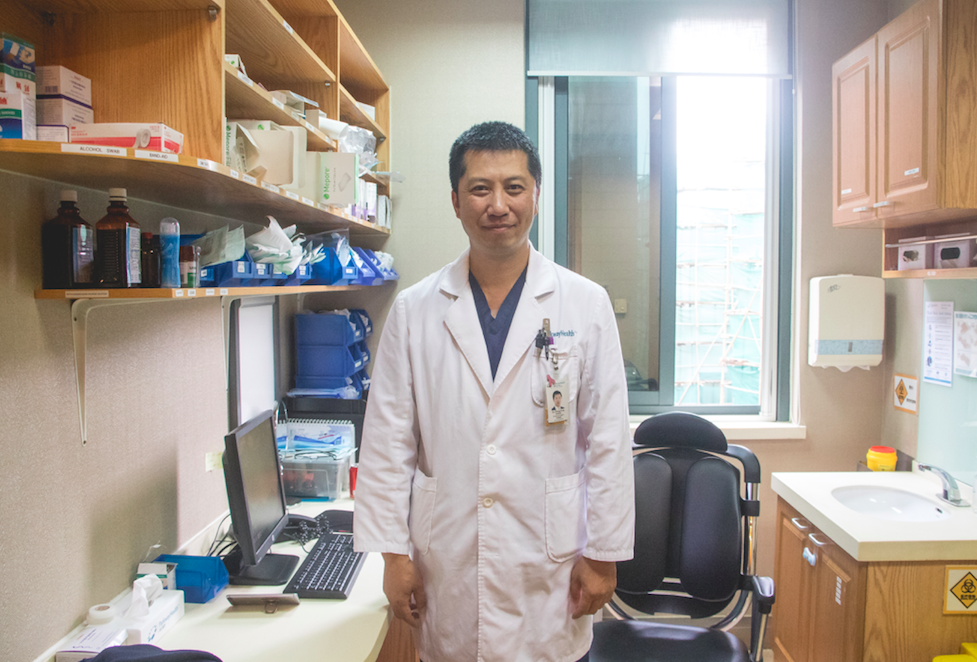

Since private hospitals have higher out-of-pocket costs for patients, they usually cater to citizens with private insurance, including foreign expatriates, medical tourists, and affluent Chinese individuals. These hospitals further attract patients by providing service-oriented care with lengthier patient visits and an increased emphasis on preventative care. Dr. Zhang, a laparoscopic surgeon, said he used to see 50 outpatients/day while working at the public Shanghai First People’s Hospital. Now that he transitioned to the private Parkway Health clinic, he can comfortably spend up to 1 hr with his patients and only sees around 10 outpatients/day. With this freedom he can “go over risks and symptoms in detail” while providing preventative care, spending “more time to help patients think about issues that they didn’t even previously consider.”

The private sector is viewed as a solution to help address the growing unease around how the Chinese healthcare system can support the rapidly aging elderly population and the increase in chronic diseases. Accordingly, public policy has encouraged growth in the private healthcare market. In 2009, the government allowed physicians to practice at multiple sites to help them simultaneously work in private and public hospitals. Additionally, the government lowered barriers to private investment in healthcare. In the 13th Five-Year Plan, the government allowed up to 100% foreign ownership in private hospitals, which previously required a minimum 30% Chinese ownership, and encouraged private elderly and home care services. Additionally in 2014, private investors were allowed to acquire and manage existing public hospitals.

Systematic Issues for Private Hospitals

The most substantial issues facing private hospitals are the recruitment of high-quality physicians and the lack of public insurance coverage. Although the government now allows physicians to practice at multiple facilities, this practice is still uncommon. Since the primary employer owns a physician’s medical license, physicians must be granted special approval to practice at additional locations. However, hospitals are unwilling to share physicians that they have already spent considerable resources training.

The stigma against public hospitals also impacts physicians. Physicians mainly aspire to work for large public or academic hospitals for the prestige, larger facilities, job security, and research opportunities. For these reasons, many physicians elect to work for public hospitals, even if salaries are higher in private hospitals and clinics. Dr. Zhang stated, “Not many doctors want to switch over to private hospitals” due to the “lack of prestige, big differences in environment, and the fact that China’s private hospitals have bad reputations.”

Due to the stigma and logistic barriers, multi-site physicians are rare. In 2015, only less than 2.2% of China’s over 2 million physicians applied for a multi-site permit. In general, private health clinic and hospitals have difficulties attracting experienced physicians. Dr. Dai, an orthopedic surgeon in a public hospital, noted that “most physicians in private hospitals are closer to retirement, from other provinces, or have less amounts of training.”

Another major issue is the limits to reimbursements by social health insurance schemes. Some private hospitals are granted exemptions to give reimbursable treatment by public insurance. However, there are very few of these special cases (37 in Beijing, 43 in Shanghai, 40 in Hangzhou, 17 in Harbin), compared to the total number of Chinese hospitals (over 29,000). Since public health insurance schemes cover 97% of China’s population, private healthcare is out of reach for most everyday citizens.

Dichotomy of Public Opinion

For any company in China to achieve success, they must gain the trust of the majority of Chinese citizens and create a positive public perception. Unfortunately, many people either associate private hospitals with inferior care or believe that they are worthwhile, but just too expensive for the services they provide. The following quotes highlight some of the prevailing opinions on private hospitals.

Inaccessibility Due to Cost

Patients who lack significant disposable income believe that private hospitals exist beyond their means. Since public health insurance already covers a majority of their medical costs, they don’t see any pressing incentives to pursue private options.

- “I have never gone to a private hospital because the out-of-pocket costs are higher and they don’t have reimbursements. Only rich people go to them, but I have no money.” – Early 70s woman from Shanghai

- “Why would I go to private hospitals? They might be better but are much more expensive. Public hospitals are cheaper, more accessible, and still have good doctors.” – Mid 40s man from Nanjing

Physician Expertise

Patients highly value the expertise of the physician treating their condition. Since public hospitals see a significantly higher patient volume, some people assume that these physicians have better clinical skills because they have more opportunities to practice. Additionally, the prestige that attracts top physicians to public tertiary care hospitals further reinforces this belief.

- “Public hospitals see so many more cases so that smaller hospitals can’t compare. If a sick person goes to a private hospital, it’s possible the doctor has never seen their condition. However, if they come here, Zhongshan Hospital, there are so many people with the exact condition.” – Late 40s man from Shanghai

- “Private hospitals have good customer care/services, but their medical expertise is subpar.” – Early 30s woman, Endocrinologist from Beijing

Historic Stigma

Since private hospitals are a relatively recent development, they still face stigma from when private hospitals were less prevalent and more associated with corrupt or illegitimate medical care. This stigma is usually more widespread among elderly patients than younger citizens.

- “Here in China, private hospitals provide the worst care, and no one trusts them. I don’t want to have to worry that I am getting overcharged so that they can earn money.” – Late 50s woman from Shanghai

The Future of Private Healthcare

Overall, both investors and the Chinese government see vast opportunity in private healthcare. Investors are interested in profiting from the projected growth and increased revenue, which is estimated to reach $90 billion by 2019. The government is also prioritizing the development of private options to mitigate the potential healthcare crisis associated with the country’s growing elderly population, increasing chronic conditions, and overcrowding at tertiary-care hospitals.

The recent rapid growth of private healthcare facilities is immensely promising. However, significant issues must be addressed to integrate private healthcare into the Chinese medical system fully. For sustainable success, private healthcare will need to strengthen public trust, attract experienced physicians, address barriers for physicians to practice at multiple sites, and make private options more affordable for the general public. Private hospitals will have to effectively target a larger segment of the Chinese population than just the top 1%, who also often resort to overseas medical tourism, and focus on attracting or sharing elite medical talent since patients will follow prestigious physicians. Finally, private hospitals must continue to provide value for their patients by providing preventative care, patient-centered experiences, and access to modern medications and technologies.

To learn more about the current status of Chinese healthcare and health technology startups, please see our other post on this topic: Challenges & Opportunities. For more information on the future of Chinese healthcare, keep an eye out for a full report that will be released in the coming months.

This article was researched and written by Caroline Lee, Research Analyst at Collective Responsibility.