Talk of robots replacing labor is everywhere, and a quick search will bring up a host of articles proclaiming our “jobs are at risk” or “the robotic revolution” is upon us.

Over the last couple of months we at Collective have been conducting research into the future of labor in China and understanding robotics and automation has been a key area of interest. Throughout this period we have found that despite the hype, a calmer approach to the “robots are going to take our jobs” mantra is required. Particularly as many of China’s factories are still working their way through the labor-intensive Industry 2.0.

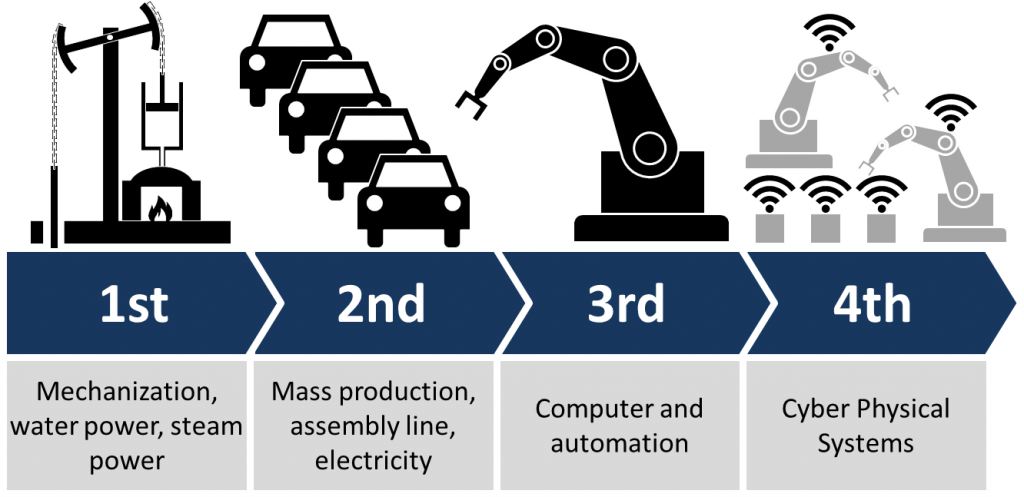

With some factories incorporating basic automation, few if any have taken steps that would lead one to foresee a large scale move to Industry 4.0 in the next few years. Which means that while robots may sell newspapers, they are not the “silver bullet” for a manufacturing sector struggling with rising costs, and here is why.

Labor: it’s a cost thing

Robots are highly technical, highly intelligent pieces of machinery representing the pinnacle of manufacturing development and as a result, they are expensive. All investment must be balanced against alternative processes and for many actors human labor is a cheaper, much less risky investment. In the “developed” world where labor is more expensive, higher skilled and less willing to work in factories, robotics investment makes more sense but at present in China, labor is an affordable alternative.

Different products require different skills

Despite the growing complexity of robots, they are still unable to rival the wide perception of humans and whilst robots are very good at doing certain tasks they are not at others. For example, highly repetitive, precision tasks robots win out but when it comes to the need for high dexterity or intuition, humans are superior. Take two examples within the textile industry, synthetic footwear assembly is now highly automated due to modern bonding processes and the introduction of woven pieces, but bedding, a higher skilled sewing process is yet to see any kind of uptake. There is no one size fits all robot, they have to be well designed for industrial sub-sectors.

Shortening product lifespan

In many industries product lifespans are getting shorter and as a result, flexibility within production is require. This is particularly the case in the 3C electronics industry and whilst there are robots that have the capabilities to react to different product types at the assembly stage, in China, labor is dominant. All component parts are developed through automation but at the point of assembly, where dexterity and perception are required, labor is key and we see little movement in this area over the next 5 years.

Governments don’t like unemployment

The introduction of automation often results in the direct replacement of humans. This is a “big deal” for China’s national and provincial governments and means that moving to a low labor situation is not a “no-brainer.” This can make the opening of high tech factories in China’s inner, less prosperous provinces easier. The companies can start with a clean slate, government incentives and high investment that leads to employment where there was none, is far preferred to high investment that leads to wide-scale unemployment. Whilst incentives are coming from governments to invest in areas such as Guangdong and Beijing, investment must be balanced with job creation.

For large companies it is achievable, for SMEs it is not

Foxconn’s one million robots and statements of intent was one of the first waves in Chinese robotic development. Whilst we see little evidence of this stimulating widespread uptake, it is the Foxconns of the world who are able to invest heavily in high tech machinery – they have the capital and large orders to guarantee ROI. But in China, a huge amount of export volume comes from smaller factories organized by companies such as Li & Fung. Individually these factories have far less capital to invest and orders are not guarantee – this makes automation investment much riskier. And in reality, not even Foxconn have been able to develop the volumes they hoped for.

Chinese industry and factory attitude

Once the installation is complete, the work is not over. Chinese factories have an attitude to machinery that does not lend itself to long-term sustainable automation; they are well known for a lack of care, maintenance and running the machines until they break. This can cause a major problem to efficiency and lead to factory downtime; this is a vital issue that must be addressed amongst small to medium Chinese factories before robots can be a success. Similarly, given many Chinese factories have not embraced automation of Industry 3.0 skipping a step to 4.0 can compound these operational problems further due to complete lack of experience.

So while investments are certainly occurring in China and the “Made in China 2025” legislation is stimulating movement up the value chain and automation uptake, the pervasiveness spoken of is not the reality on the ground. Industry 4.0, the new wave of manufacturing, is an area of continued investment but automation is one part of this and robots only a fraction of automation. China is also starting from a much lower baseline, with robot to worker ratio currently at 30/10000 to Japan’s 300/10000, and whilst robot technology is rapidly developing there is far more to consider than simply technological capabilities when investing. As a result, we don’t see large-scale uptake within the next 5 – 10 years and for some industries and sub-sectors, it could be much longer.

Feature Image Credit: Wikipedia