Consumer-based companies have long predicted that the future of consumerism rests in the wants and needs of the next generation. China, however, is presenting an entirely different story. The Chinese market suggests that the elderly are the next big source of consumers, and are spending in new and unique ways. Not only are the elderly in need of community center clinics and nursing homes, but are also in need of travel services as they become increasingly adventurous tourists. At Collective Responsibility, we have identified several asset-based and service-based market opportunities that encompass these trends among elderly consumers. Asset-based opportunities involve building nursing homes, health centers, and other capital-intensive projects, while service-based opportunities involve catering to elderly peoples’ leisure and travel needs.

The Graying Population and Market Shifts

Why are the Chinese elderly of tomorrow so different than the elderly of today?

Firstly, their family dynamics have changed significantly. The Chinese family traditionally includes three generations living within one home. The family’s youngest members must provide in-home care and support for the oldest members, but this model is becoming less and less feasible. The combined forces of urbanization and the One Child Policy have placed an unnatural burden on the traditional nuclear family, and created a serious demographic imbalance. Urbanization has forced families into smaller living spaces, making the three-generation household cramped. The former One Child Policy has also exacerbated problems, placing an unequal burden on only-children who care for up to two parents and four grandparents.

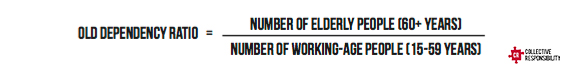

The old dependency ratio (ODR) quantifies the increasing burden elderly people place on China’s younger working population.

The ODR is poised to continue increasing over the next decade, and will present new challenges for care providers. In particular, the elderly care market is struggling to meet this burden. As families realize they cannot provide healthcare, leisure, and travel services for multiple grandparents, they will begin outsourcing this care to nursing homes, travel agencies, and recreation centers. Asset-based services and service-based industries will become major investment opportunities. In the face of this trend, elderly needs and living preferences. should be investigated. In particular, how the elderly will embrace future living styles, and how we can meet their demands.

The ODR is poised to continue increasing over the next decade, and will present new challenges for care providers. In particular, the elderly care market is struggling to meet this burden. As families realize they cannot provide healthcare, leisure, and travel services for multiple grandparents, they will begin outsourcing this care to nursing homes, travel agencies, and recreation centers. Asset-based services and service-based industries will become major investment opportunities. In the face of this trend, elderly needs and living preferences. should be investigated. In particular, how the elderly will embrace future living styles, and how we can meet their demands.

Elderly at Home: Asset-Based Opportunities

Asset-based opportunities are largely investment-led. They require a large initial capital investment, but yield essential institutions like physical service centers. One of the largest areas open to foreign investment is senior care infrastructure, including nursing homes, recreation centers, and health care centers. Previous studies by Collective Responsibility show that 45% of young people prefer their parents to live with family and 47% prefer parents to live independently. Only 2% prefer parents to live in a nursing home. Independent living is the most popular option, but still not the most practical. When elderly people live on their own, they often lack access to accessible leisure and healthcare services. To meet this need, investors should focus on community infrastructure that allows the elderly to be independent, but have easy, close access to care, exercise, and recreation facilities.

Elderly on the Move: Service-Based Opportunities

While asset-based services can help shape new homes and community centers for the elderly, service-based opportunities can further shape their lifestyles. Service-based opportunities require less investment of capital and involve largely consumer-led ventures. They address leisure and enrichment activities, and are important points for development as the elderly have more disposable income and enjoy increasingly diverse leisure activities. The term ‘empty nesters’ takes on a whole new meaning in the Chinese market. Instead of parents and grandparents saying farewell to their children, the Chinese elderly are leaving the nest. They demonstrate an increasing willingness to travel domestically and abroad, and are poised to be an emerging and fast-growing demographic in the tourism industry. Of course, this increases demand for travel services.

Ultimately, over the next few years we can expect to see an increasing need for senior services. These range from community-centers, to travel services, to local recreation centers – all of which allow the elderly to live independently. As investors consider entering the Chinese market, they should consider how urban and demographic changes have altered consumer needs. In particular, they should consider potential for growth in both asset-based and service-based industries.

This article was written by Kendall Tyson, Research Analyst at Collective Responsibility.

Featured Image Credit: South China Morning Post