2017 has just begun, and one question is on everyone’s minds: what exactly will the new year bring? In particular, companies in China want to predict and adjust for major trends, and wonder what upcoming news could affect their operations.

2016 was a tumultuous year for Chinese markets. The Chinese Communist Party issued its second red alert, closed factories across the northeast, tackled rising corporate debt, and struggled to maintain a stable currency. It was also a year of innovation, however, with enhanced drone technology, growth in AR and VR tech, and international investment in Chinese apps and sharing platforms like Didi.

Many of these stories from 2016 remain relevant, and some involve new updates on a daily basis. In a news glut, it can be difficult to spot major trends, developments, and potential stumbling blocks in advance.

With this uncertainty in mind, we’ve made a roadmap for Chinese markets, complete with top predictions in energy, economics, and tech that will shape sustainability during 2017.

1) Push for clean coal

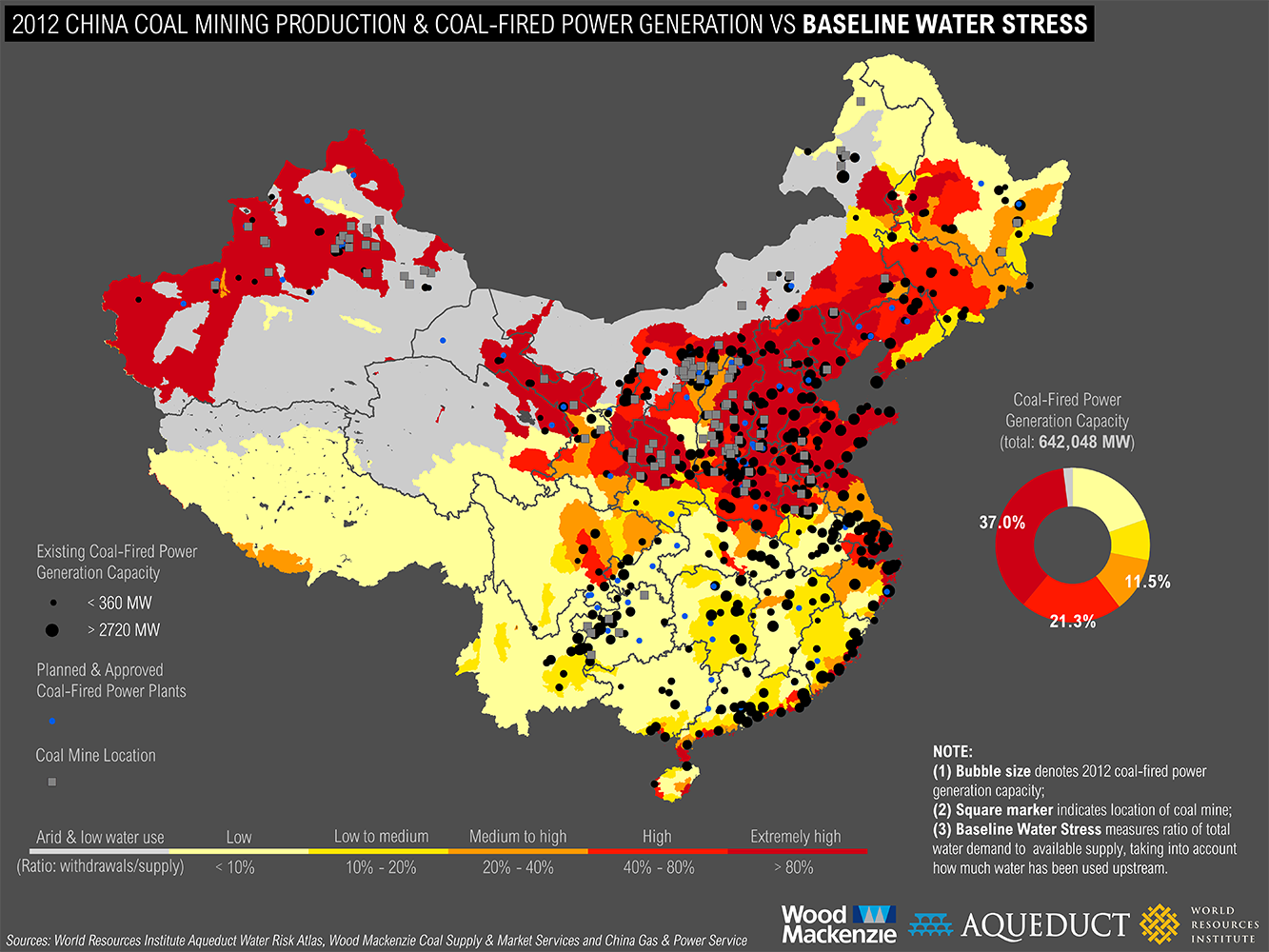

China’s energy story to watch will certainly revolve around coal. During the last week of 2016, China hosted its annual economic work conference, and set ambitious coal and energy targets for the following year. The country now plans to reduce domestic coal production by 300 million tons per year until 2020, use cleaner coal, and virtually ban new mining and production activity in the Northeast. According to the 13th Five Year Plan, provinces on the East coast – including coal giants Beijing, Tianjin, and Hebei – will no longer build coal mines. Beijing will no longer produce coal at all, and Hebei, Jiangsu, Fujian, and Shandong will significantly decrease production levels.

Looking closely at the numbers, it seems that China isn’t just looking for a reduction. Plans dictate a total shift from the East to the West, with nearly all consumption and production power centered on three western provinces. Xinjiang, Shanxi, and portions of Northern Mongolia might actually see boosts in mining and coal production, as they increase production levels by 500 million tons over the next 4 years.

New Coal Standards

The shift signals a stronger commitment to new, cleaner coal. New mines and coal powered plants in Western provinces will incorporate clean tech and manufacturing techniques. In new plants, workers will isolate impure and carbon-intensive elements, either crushing and burning powdered coal or using only gaseous coal. More outdated plants in the Northeast, in contrast, will either face pressure to modernize or shut down — especially during the polluted winter season. If Beijing, Hebei, Tianjin, and other coal hubs face another red alert period, the government might be forced to accelerate closures, or risk looking negligent when the PM 2.5 exceeds 400.

Controlling Coal Prices

Predictions:

Chinese officials have so far committed to these goals. They cut 12.4 gigawatts of coal power, announced factory closures, and released the coal-specific Five Year Plan. During Spring and Summer, however, they could back down a little — especially as the smog clears and plants have tight supply. Over the past year, miners and plant workers struggled to keep up with production cuts, maintained large coal reserves, and at one point, saw prices rise nearly 50% yr/yr. In an effort to control prices, officials retreated from some commitments, and reluctantly made a few concessions.

The biggest? Beijing and surrounding cities could expand production days, and work past Xi Jinping’s official 276-day annual limit. Many mines still work beyond this limit, and could continue to do so well into 2017.

This clearly conflicts with China’s environmental goals.

Specifically, mines could produce more coal in 2017, not less, and keep feeding a large supply to northeastern plants.

If steel and coal prices again increase beyond an acceptable point, will China make another concession? Perhaps. As soon as mines return to 276-day production stints, supply of coal will decrease and prices will rise. A similar crisis will likely force similar concessions, and officials could find themselves increasing instead of decreasing production levels — with higher supply in both the northeast and the northwest.

This could become a challenge for officials in 2017, and force them to choose between inflation and pollution.

2) Reduction in waste & overcapacity

In 2017, the government has pledged to tackle overcapacity and waste. The Thirteenth Five Year Plan announces less support toward state owned enterprises, especially those in steel and heavy industry. Many government subsidized factories are overcapacity and highly in debt. They are currently the largest segment of corporate debt — a whopping 169% of GDP.

This huge debt ratio and a need to tackle factory pollution could spell the end for many steel plants, and signal not only production cuts, but factory closures.

Waste reduction won’t just apply to factories, but also to consumers and product developers. 2016 was China’s highest consumption year on record. People in China ordered nearly 21 billion packages — more items from Taobao, Tmall, and takeout apps than in any previous year. This number will likely rise in 2017, and signal more cardboard, plastic, food, and packaging waste.

Much of this waste goes directly to landfill, but many cities are facing a resource squeeze in 2017. Shanghai, for instance, has announced that two of its five government run landfills will close by 2017. The District Greening and City Appearance Bureau plans to build the city’s first government-sponsored recycling centers, but what will happen in the interim?

Predictions:

Private companies will need to respond. Sustainable leaders can do a number of things to address waste challenges. First, they can design for dismantle, removing any unnecessary or hazardous parts. In addition, they can clarify sorting, and offer more options on community waste bins: food, plastic containers, glass, paper / cardboard, and electronics.

3) Boost in urban infrastructure

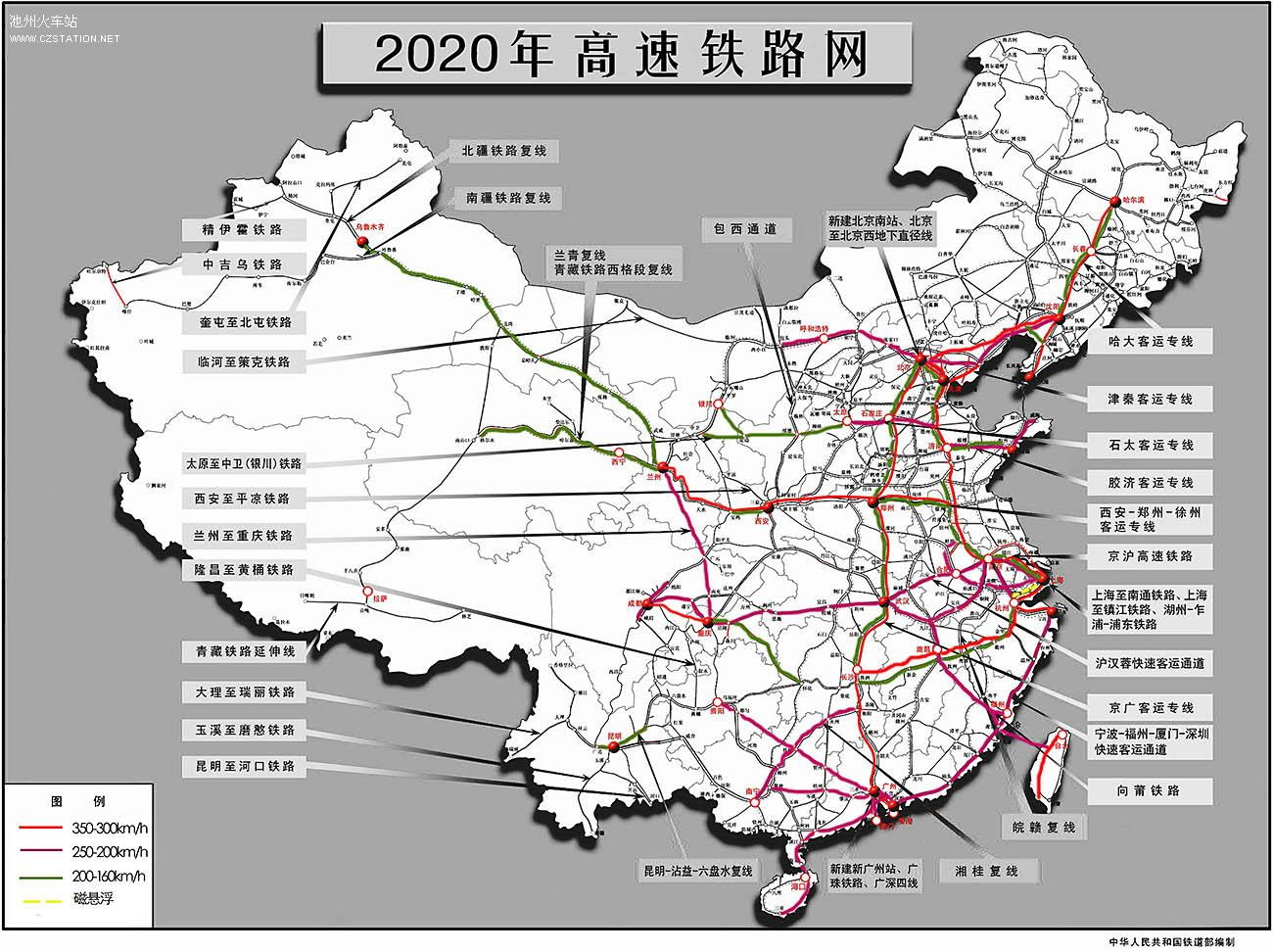

China largest economic boost will likely come from transportation. As China’s urban population increases, the government has provided more funding for freight and high speed rail — connecting formerly rural areas to city centers. China Railway Corporation announced an 800bn RMB spending budget for 2017. They will add 5,000 kilometers of new domestic single-track railways, and develop new projects like the Beijing-Tianjin rail network.

Predictions:

China’s biggest transportation development, however, will likely be international. Over the past two years, Chinese companies have negotiated deals with over 20 countries, and many of the projects begin construction work in 2017. In particular, high speed rail lines and freight trains for Thailand, Indonesia, Singapore, and the UK. The UK freight service will perhaps prove the biggest challenge, but increase construction and infrastructure by a considerable margin as the train will cover 12,000 km, and potentially inspire deals with other European countries for intra-European or intercontinental delivery routes.

4) More self-driving car models

Both of these stories require some attention. In December 2016, Google announced a new spinoff division – Waymo – which will manage research and development for Google’s self driving car model. The new company has already announced a partnership with Fiat Chrysler, and plans to release its model by the end of 2017.

Predictions:

Google is not alone in anticipating this demand, and will inspire other spinoffs. Uber, General Motors, Mercedes, Volvo, Tesla, Apple have also begun investing in self-driving tech. Mercedes, for instance, has already partnered with international companies like Autoliv to research and manufacture safety and sustainable features for self-driving vehicles. Special emergency brakes, evasion tech, and airbags require new designs, and could inspire a surge in start-ups that focus on car components, safety features, and enhanced in-car tech like virtual reality.

5) Added pressure to foreign companies

Within the first two months of 2017, President-Elect Donald Trump will have a confirmed Secretary of State, head of the National Trade Council, and U.S. Trade Representative. Rex Tillerson, who will likely receive Senate confirmation, labels China as an adversary. During his confirmation hearing, he clarified that the U.S. cannot allow China to access manmade islands in the South China Sea, and that the U.S. must develop a hardline. Peter Navarro, similarly, wrote multiple books about Chinese currency manipulation and export dumping schemes, including Death By China and The Coming China Wars.

Both figures will likely take a firm stance on China at the WTO, and could encourage harsh tariffs if provoked. For instance, if Chinese leaders face an economic crisis over the coming year, and must use foreign exchange reserves to stabilize the yuan, it could prompt retaliation. The President-Elect views any currency manipulation as a tool — an attempt to weaken American exports and strengthen Chinese competitiveness.

Predictions:

In response, Chinese officials could continue a preexisting trend, and tighten their grip on foreign companies. Many companies –even sustainable ones — could face stricter monitoring and expensive litigation. The maneuver has been used before. Johnson Controls, an international leader in sustainable batteries, was targeted in an official report in 2012. Its factory in Kangqiao, Shanghai was accused of contaminating city water, but denied any illegal activity. Within a year of the report, officials ordered Johnson Controls to leave China — and offered few opportunities for the company to defend itself.

This type of story could become more common.

International companies subject to more surveillance and public shaming — all to deliver a diplomatic message.

This article was written by Alison Schonberg, Research Analyst at Collective Responsibility.