Air travel is fast becoming the most popular form of international travel, and the industry in China is no exception to this. Commercial flying in the world’s second-largest economy has had an immense amount of investment over the past decade, and it is the fastest growing passenger air market in the world. With the expectation that 300 million more people will move to cities over the next twenty years and with it the growth of the middle class, there is little sign that of this growth will stop anytime soon – this growth will certainly have an impact on the economy, mobility and the environment.

Not only is air transport quick and becoming cheaper, but air transport creates many economic benefits including GDP contribution, job creation, and passenger benefits. In 1980 a mere 3.4 million people used air travel, but in 2010 this number reached a record high of 564.3 million through 175 Chinese airports.

In response to growing demand, the industry has purchased more aircraft and recruited more staff. Continued expansion and development of infrastructure are fueling the growth of the industry, and over the next 20 years, major investment is expected, with Chinese airlines projected to spend $340 billion on 3400 aircraft.

MegaTrends in domestic air travel

After China opened its borders to the world and reforms were put in place in 1978, hundreds of new airports have been constructed, and the network of air passengers has grown and changed. Here are a few reasons why air travel has been rapidly on the rise:

- The growth of the middle class and personal wealth – the main factor driving the growth in China’s middle class is the transition from an export and investment-led economy to a consumer economy. Rapid urbanization in recent decades has increased demand in many sectors.

- Industry Investment – More than 100 new airports have been built and the network is continuing to expand to 2020. More airlines exist and have been restructured, whilst the growth of the tourism industry and low-cost packages increasing flight frequency.

- Increased business travel – Increased infrastructure, has allowed business in more remote areas to thrive and business travel is developing this is an important part of passenger increase and business development for airlines.

- Increased domestic tourism – with the increase in affluence more Chinese citizens have taken an interest in domestic tourism. This has created a demand for more travel options and has been one important factor in the growth of the airline industry.

- Expansion of international tourism – Compared with the already significant domestic travel market, the Chinese market for international travel is still young. China Business Review predicted that Chinese international travel would likely increase by 17 percent per year between 2010 and 2020, driven by rising incomes and aspirations. Chinese tourists are increasingly visiting other parts of Asia and even to destinations such as Europe, Australia, and New Zealand.

Challenges in the Chinese Industry

Flight Delays and Cancellations

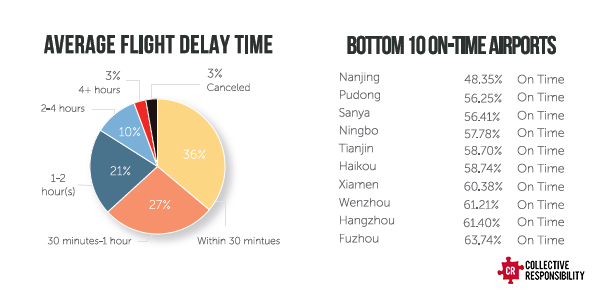

China’s airports are notorious for having a huge number of flights canceled, and a majority of flights delayed. While these delays and cancellations can sometimes be attributed to poor weather conditions, they are in large due to the military restrictions of the airspace. In July 2014, hundreds of flights in and out of Shanghai were canceled without warning to make way for military exercises that lasted two weeks. The military was unapologetic, and the civil aviation authorities, whilst embarrassed, were unable to do anything to fix a situation.

80 percent of China’s national airspace is devoted to military uses, with much of it overlapping or affecting prime commercial aviation corridors. By contrast, the U.S. military controls 20 percent of U.S. airspace, mostly over remote or ocean areas. China’s Civil Aviation Administration reported that one-third of all mainland flights failed to take off on time in 2014, the fourth consecutive year of increase.

In March, seven out of the world’s 61 largest airports with the lowest rates for on-time departures were Chinese. Flights leaving Shanghai’s Pudong Airport, the busiest international airport in China, managed on-time departures only 37.26 percent of the time.

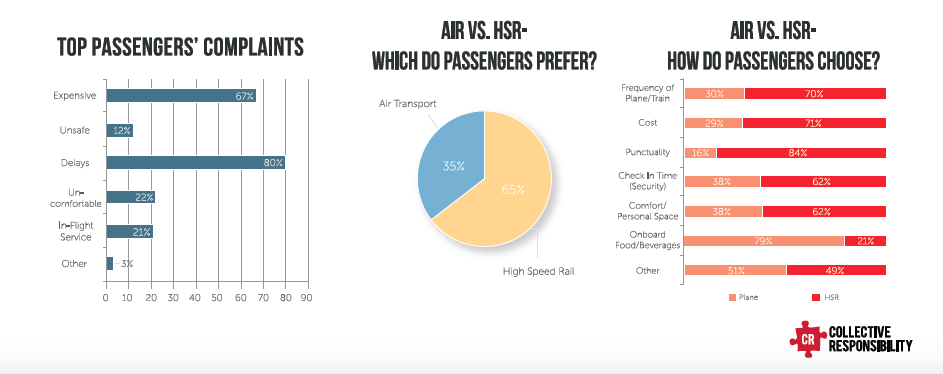

Expansion & popularity of HSR

Around the world deciding whether to take the train or plane over a long distance is a no-brainer – the convenience, speed, and comfort of domestic and international air travel are unrivaled. However, in China, the development and implementation High Speed Rail (HSR) has meant that for many the decision is not so easy. Over vast distances, air will win but when taking a decision between HSR and air, when traveling the manageable distance from Shanghai to Beijing, HSR comes out on top for the majority of individuals.Collective Responsibility analysis provides insight into the reasons behind these choices, providing a worrying outlook for private companies looking to invest in domestic air travel. In all but 1 specified category people prefer the service provided by HSR those with an overwhelming advantage are frequency, punctuality, and cost. Aggressive expansion plans are in place for airport infrastructure with many more airports expected to be complete construction by 2020. This will vastly increase traffic in the sky and stakeholder within the industry must address these pervasive issues – specifically in the control of airspace and subsequent delays.

Sustainability – A Massive Carbon Footprint, or Higher Efficiency?

While air travel is certainly quicker and growing in popularity, there are significant impacts to the environment and daily life to be considered. Emissions from the aircraft, noise pollution, loss of arable land, and threats to birds are all serious negative outputs. Pollution from the aviation sector already accounts for an estimated 3.5 percent of the total human-caused contribution to global climate change, and the International Air Transport Association (IATA) expects this share to grow to 5 percent by 2050.

China is reportedly planning to target energy and aviation emissions among six industrial sectors when it launches its carbon-trading scheme. As one of the largest emitters, the country is currently piloting an emissions trading system across seven provinces, ahead of a national rollout in 2016. The scheme would initially target six industrial sectors: power generation, metallurgical, nonferrous metal, building materials, chemicals, and aviation.

Operationally, and something specific to China is that while modern aircraft are generally more fuel-efficient the higher they fly in China military restrictions may keep jets at 10,000 or 15,000 feet, where they burn higher levels of fuel. A major problem for fuel optimization, especially when the industry is facing pressure to reduce emissions.

While challenging, there is some hope for future emissions though as airlines are experimenting with biofuels, a more eco-friendly alternative to the traditional petroleum mix. In March 2015, a scheduled Hainan Airlines flight, carrying more than 100 passengers from Shanghai to Beijing, used biofuel made by Sinopec from waste cooking oil collected from restaurants in China. Both of the airplane’s engines were powered by a fuel blend of half aviation biofuel mixed with conventional petroleum jet fuel. The flight arrived safe and sound and was celebrated as a step in the right direction.

Looking forward

In spite of the recent economic slowdown, China’s domestic aviation market is only expected to grow. In August 2015, Boeing released its latest market outlook, which forecasts China’s domestic air travel market to become the largest in the world, and for China’s commercial aircraft fleet to almost triple by 2034. With this expected increase in capacity China’s systems will be continually tested and in order for the industry to cope a restructuring on a number of sides is required. A current military dominance of airspace will have to be relaxed in order to allow a growing number of flights. As China moves through its final economic transition to a tertiary service-based economy, air travel will be more sought after and delays and cancellations will have a greater impact on local and national development.

The expectations of greater supply will likely lead to lower prices and greater accessibility for individuals. Given this, it is not just the air systems that must prepare for a greater influx of people but the destinations themselves. As more people have the ability to travel to popular destinations will have more visits, particularly at peak times, and must prepare for these in order to cater in a sustainable manner. If not then locations will be unable to cope and risk destroying what they have built and preserved – infrastructure around airports will have to be well planned.

The future for air travel is bright and its impact on the Chinese businessperson and consumer could be great but it is a situation that needs to be well managed in order to develop long-term efficiency. The development of biofuels is a positive development to limit externalities, but it is the readiness of the systems themselves that will be the decisive factor in strong, sustained development.

This article was written by Rachel Sorenson, Research Analyst at Collective Responsibility.