High material use and consumption is synonymous with the development of an economy, particularly an evolving one such as China, which over the last 20 years has focused heavily on the primary and secondary industries to drive growth. However, China’s economy is now changing from one of heavy industry to one that is looking to meet the wants of its ever-increasing domestic consumers.

But what has this meant for waste production? And how will waste be affected by the change in economic framework? These are questions that we consider important, given that there will be an additional 300 million urban consumers in China by 2025 – consumers that have already begun adapting to a “modern lifestyle” and are consuming white goods, consumables, and packaging at ever-growing numbers.

“So I would say that is a huge potential, and if we look at people’s geographic spread, half of our population in the low-tier cities and rural areas, that’s why we initiate our rural program.”

– Alibaba’s new chief executive, Daniel Zhang

Given the scale of growth in consumption, and its changing nature by which goods are being packaged, delivered, and disposed of, the implications of these wastes are at the front of many minds. Put simply, when addressing the issue of material flows, any material that enters a system, in this case China, must either be converted into stocks (buildings, cars, infrastructure) or enter the waste stream, where it is disposed of, reused, or recycled.

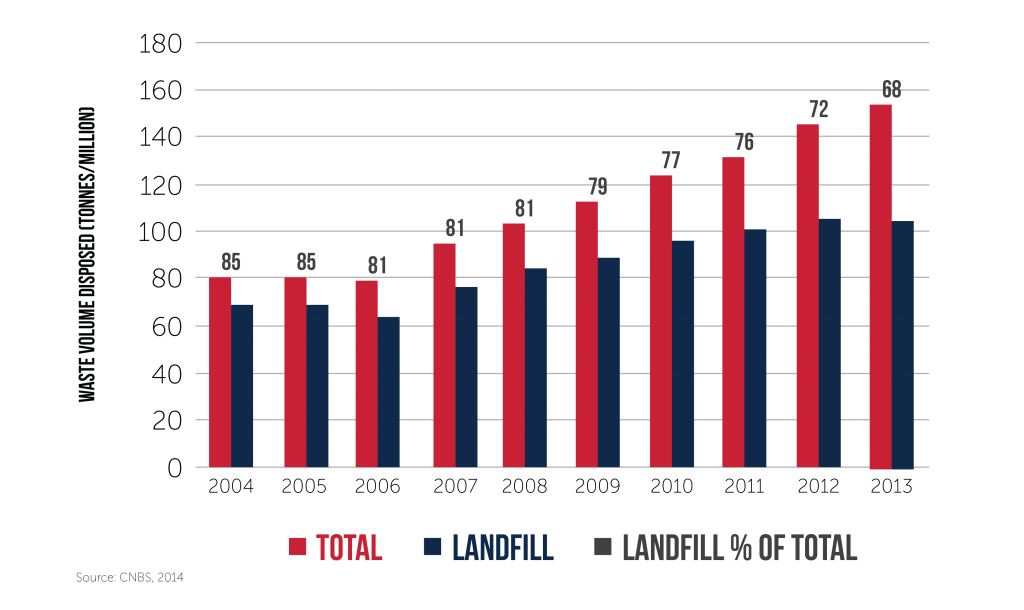

The principle can be thought of in line with the first law of thermodynamics, in this case energy is replaced by material resource – “materials within an isolated system can neither be created nor destroyed, just transferred”. The greater the material influx, the greater the chance of higher waste production. It is, therefore, unsurprising that China has seen considerable rises in its waste production over just the last 10 years alone.

Consumer waste streams: challenges and opportunities

You can find Collective’s newest content on the topics of waste, food waste, recycling, and e-waste on our Waste Landing Page. Follow us on social media to receive updates on our latest articles, reports, and engagements!

Alongside the more traditional waste management challenges, such as reduction in waste to landfill, handling of toxic waste, and capacity concerns, we see a number of consumer waste streams where systems will be particularly challenged going forward. These challenges will require innovative actions from a variety of stakeholders to manage them, but with this comes new opportunity. These relate, in part, to changing consumer habits with the rise of affluence and purchasing power.

As the expected population growth of cities occurs, individuals’ consumer footprints will increase, and the overall contribution to the waste stream will rise. The growth of these cities will require the development of waste management infrastructure that is both socially and environmentally sustainable. Meanwhile, greater consumer affluence will bring greater consumer voice and rising expectations – placing added pressure on many areas of the industry.

Plastic Waste

It is projected that by 2025, Asia’s plastic consumption will increase by 80%. China produces 50 million tonnes of plastic waste per year and is currently considered responsible for 28% of global plastic leakage into oceans. As a non-biodegradable substance, plastic waste is very damaging when it enters ecosystems – and the damage is difficult to mitigate. With a continuation of current waste management practices and potential consumption increase, the outlook is bleak. Despite considerable investment in incineration, a common form of waste disposal to produce energy, clear mismanagement still exists and must be addressed in order to achieve sustainability.

Packaging Waste

Higher consumption of personal goods lead to increases in required packaging, and therefore, packaging waste. This is true for a wide range of products, but one area of real development we see is in the rise of e-commerce. The sector has seen a boom in China over recent years, and packaging is an integral part of the industry. Subsequently, the level of household packaging waste will increase. As a short-term stock, fast management infrastructure is required for its successful reuse and disposal.

Food Waste

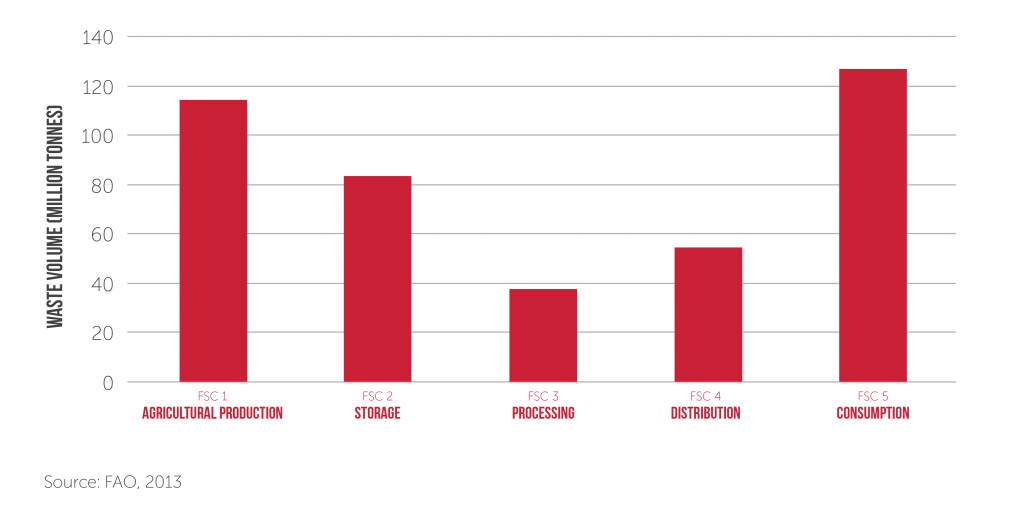

It is estimated that each year in China $32 billion dollars of food waste goes to landfill. Not only is this a major financial inefficiency for which farmers and consumers have to pay, but it is also the source for a host of environmental issues on the farm and in the city. On the farm, heavy use of fertilizers to boost nutrients has depleted the natural nutrients of soils, and historically, 15% of arable land is thought to have been rendered useless through this and other poor management styles. Runoff from these intensively cultivated lands also damages local ecosystems through nutrient pollution phenomena, such as eutrophication.

It is estimated that each year in China $32 billion dollars of food waste goes to landfill. Not only is this a major financial inefficiency for which farmers and consumers have to pay, but it is also the source for a host of environmental issues on the farm and in the city. On the farm, heavy use of fertilizers to boost nutrients has depleted the natural nutrients of soils, and historically, 15% of arable land is thought to have been rendered useless through this and other poor management styles. Runoff from these intensively cultivated lands also damages local ecosystems through nutrient pollution phenomena, such as eutrophication.

In landfills, food waste degrades in the absence of oxygen to produce methane, a highly potent greenhouse gas that is toxic to humans, and if allowed to build up, can be highly hazardous to surrounding areas for detrimental long-term effects.

These food losses are occurring all along the supply chain and must be addressees as urban migration leads to higher consumption and the capacity of agricultural lands are tested. Opportunities exist for greater efficiency in all areas, particularly within FSC1 – 3 where profits are impacted.

E-Waste

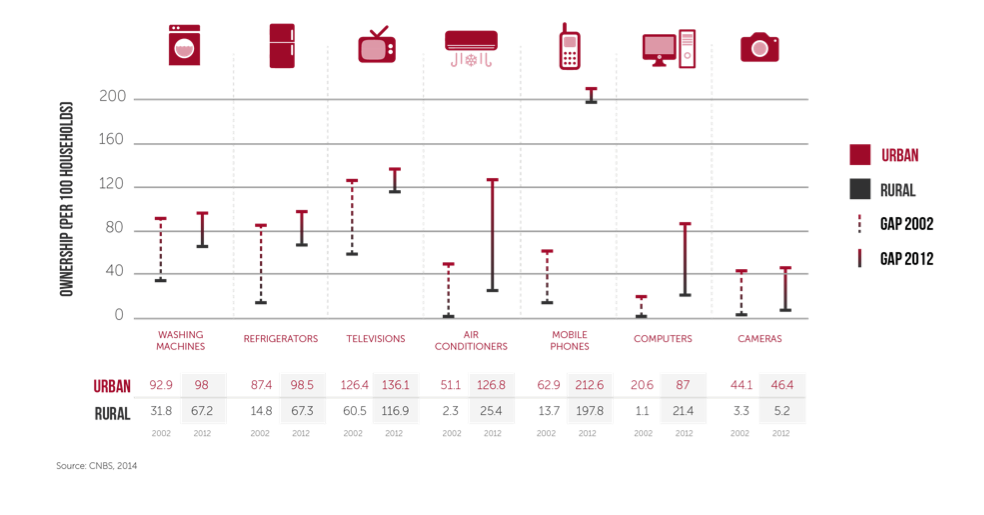

The electronic goods market is growing all over the world, and nowhere more so than in China. Urbanites’ consumption from China’s rural population moving to cities and modernizing their lifestyles will cause electronic ownership to increase even further.

For a number of electronic devices, the urban rural gap is significant. In light of this, it is highly likely that rural urban migration will result in higher the levels of e-waste. Despite the reasonably long life of these consumer goods, cyclical disposals will see the waste industry challenged.

Conclusions

China’s waste production will continue to rise dramatically with increases in urban population. Increased purchasing power and wider consumer choice will be a major driver in this area, and in order for the economic, social, and sustainable goals of 2025 to be achieved, it is important that China accelerates its waste management drive and with quality and efficiency. The level of waste runoff and poor management, highlighted by such high levels of plastic deposited in oceans, can lead not only to environmental problems, but also human health issues, and this will no longer be accepted by its citizens and international community in the near future. Swift actions are required in addressing these issues and strong measures must be taken with regards to waste reduction, and the development of greater circularity of the waste stream.

Over the coming weeks, we will develop further these parts of the waste management industry and provide insight into the specific areas addressed, outlining case studies, assessing trends, drivers and solutions as China looks to provide a sustainable framework for its waste management future.